south dakota sales tax rate 2021

Look up 2022 sales tax rates for Doland South Dakota and surrounding areas. Sales Use Tax.

2022 Property Taxes By State Report Propertyshark

Look up 2022 sales tax rates for Strool South Dakota and surrounding areas.

. Skip to main content. South Dakota has no income tax. 31 rows The state sales tax rate in South Dakota is 4500.

Raised from 45 to 65. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. Including local taxes the South Dakota use tax can be as high as 2000.

During the period beginning July 1 2021 and ending June 30 2022 the tax imposed under 10-45-2 on gross receipts from the sale of food is four percent. South Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Look up 2021 sales tax rates for Turner County South Dakota.

For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. Tax rates provided by Avalara are updated monthly. With local taxes the total sales tax rate is between 4500 and 7500.

South Dakota Sales Tax. Tax rates are provided by Avalara and updated monthly. It includes returns filed for the current period and those filed for previous periods.

Look up 2022 sales tax rates for Mason South Dakota and surrounding areas. South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. It may cover a variety of taxpayer filing periods such as monthly bi-monthly semi-annually etc.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1817 for a total of 6317 when combined with the state sales tax. The state sales tax rate in South Dakota is 45 but you can customize this table as needed to reflect your applicable local sales tax rate. Click Search for Tax Rate.

Municipalities may impose a general municipal sales tax rate of up to 2. Find your South Dakota combined state and local tax rate. The South Dakota Department of Revenue administers these taxes.

Beginning July 1 2021 four South Dakota communities will implement a new municipal tax rate. Look up 2021 sales tax rates for Lake Herman South Dakota and surrounding areas. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65.

Look up 2022 sales tax rates for Interior South Dakota and surrounding areas. Enter a street address and zip code or street address and city name into the provided spaces. 2021 Sales Tax Statistical Reports In all cases when you select a month you will be viewing data compiled from returns filed with the Department during that month.

Localities can add as much as 45 and the average combined rate is 64 according to the Tax. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

Raised from 45 to 65. During the period beginning July 1 2022 and ending June 30 2023 the tax imposed under 10-45-2 on gross receipts from the sale of food is three percent. The South Dakota use tax rate is 4 the same as the regular South Dakota sales tax.

Tax rates are provided by Avalara and updated monthly. What is South Dakotas Sales Tax Rate. 45 municipal sales tax and use tax applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or uses the product or service in a municipality that imposes a sales tax or use tax.

Skip to main content. Search When autocomplete results are available use up and down arrows to review and enter to select. Did South Dakota v.

Look up 2021 sales tax rates for Day County South Dakota. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. Average Sales Tax With Local.

Skip to main content. Search When autocomplete results are available use up and down arrows to review and enter to select. Skip to main content.

Select the South Dakota city from the. South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

Calculate rates Calculate rates. Simplify South Dakota sales tax compliance. Tax rates are provided by Avalara and updated monthly.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of. South Dakota Sales Tax. State sales tax and use tax applies to and services.

Skip to main content. Tax rates are provided by Avalara and updated monthly. What Rates may Municipalities Impose.

1 to 2 municipal gross receipts tax mgrt. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Tax rates are provided by Avalara and updated monthly.

New Municipal Tax Changes Effective July 1 2021. The maximum local tax rate allowed by South. Search When autocomplete results are available use up and down arrows to review and enter to select.

South Dakota Income Taxes. Oelrichs SD increasing its 0 percent general sales and use tax rate to 2 percent. Search When autocomplete results are available use up and down arrows to review and enter to select.

Dante SD increasing its 1 percent general sales and use tax rate to 2 percent. The South Dakota sales tax and use tax rates are 45. South Dakota has recent rate changes Thu Jul 01 2021.

The base state sales tax rate in South Dakota is 45. There are a total of 289 local tax jurisdictions across. The State of South Dakota relies heavily upon tax revenues to help provide vital public services from public safety and transportation to health care and education for our citizens.

The South Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into South Dakota from a state with a lower sales tax rate. Search When autocomplete results are available use up and down arrows to review and enter to select.

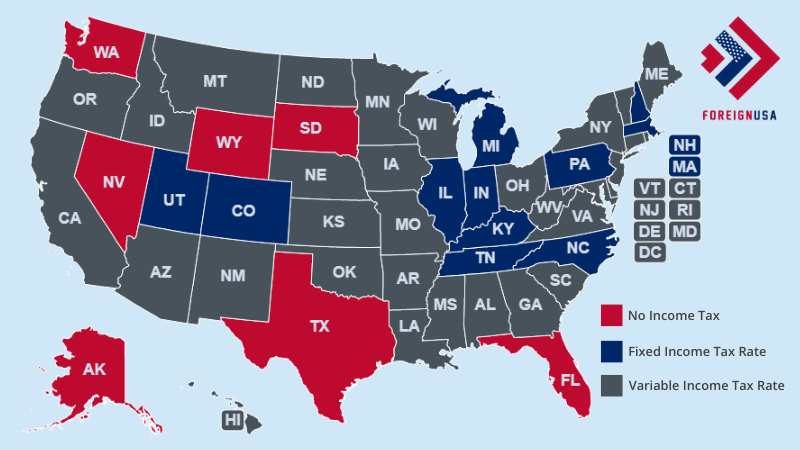

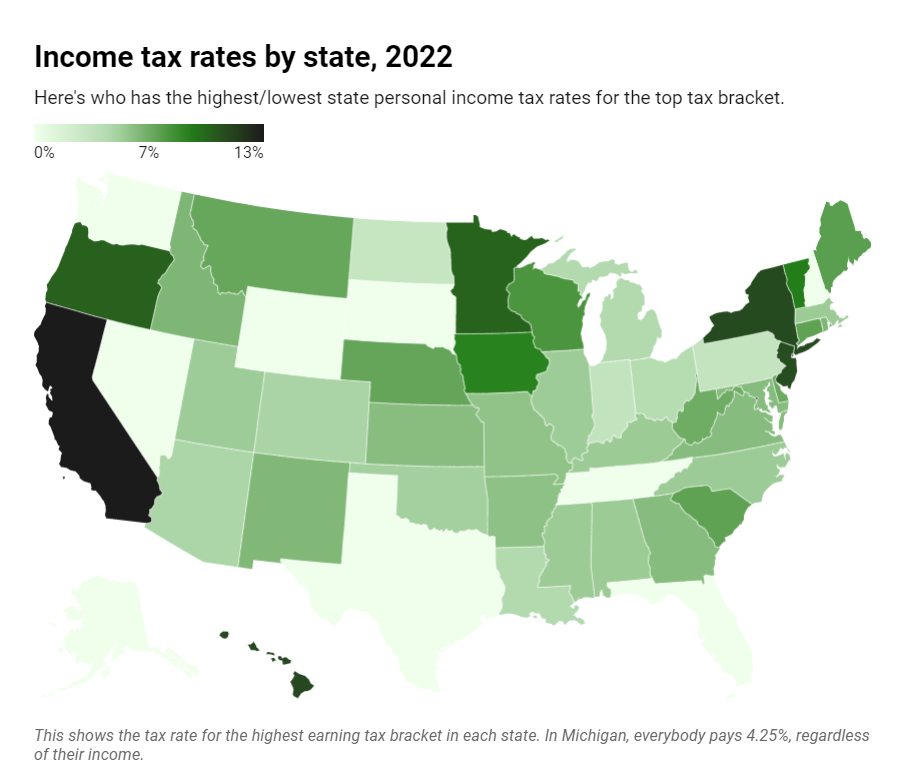

State Income Tax Rates Highest Lowest 2021 Changes

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

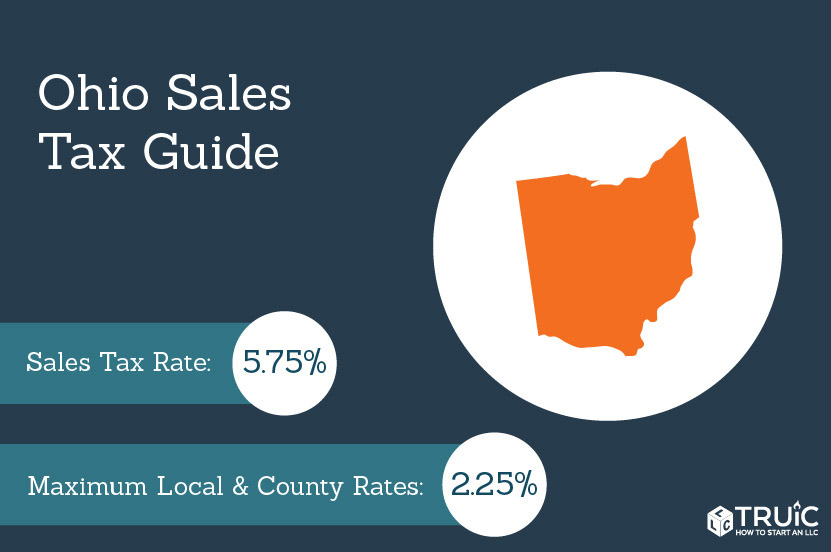

Ohio Sales Tax Small Business Guide Truic

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

How Do State And Local Individual Income Taxes Work Tax Policy Center

Sales Tax On Grocery Items Taxjar

The Most And Least Tax Friendly Us States

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

States With Highest And Lowest Sales Tax Rates

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Tax Friendly States For Retirees Best Places To Pay The Least

How Is Tax Liability Calculated Common Tax Questions Answered

South Dakota Sales Tax Rates By City County 2022

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Levy A Corporat Business Tax Income Tax Income

State Corporate Income Tax Rates And Brackets Tax Foundation